While banks have been reducing their fixed interest rate deals marginally across 2024, this month we are seeing many large and small Lenders cutting basis points on their fixed interest rate deals.

Is this in anticipation of a potential cash rate decrease? If inflation trends and global market movements continue as expected, the Reserve Bank of Australia (RBA) may lower the target rate next year.

Earlier this year, we discussed the differences between fixed and variable home loans and when it could be beneficial to choose a fixed rate. With the current landscape, now might be the right time to reassess your options.

Earlier this year, we discussed the differences between fixed and variable home loans and when it could be beneficial to choose a fixed rate. With the current landscape, now might be the right time to reassess your options.

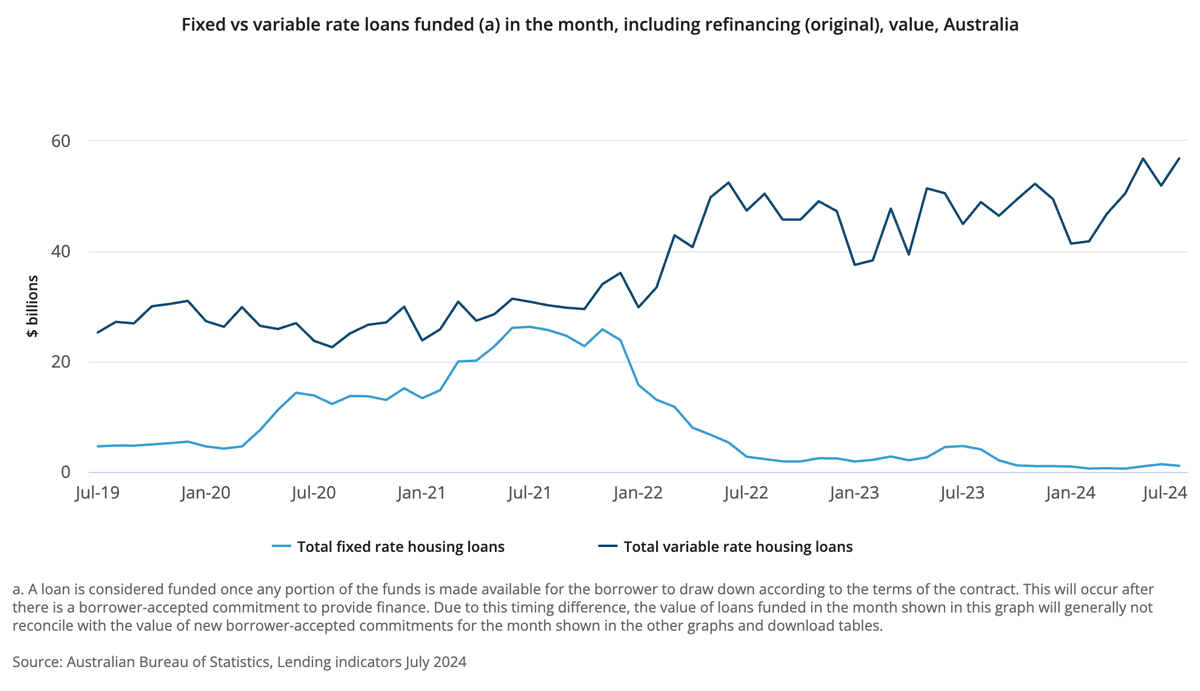

Despite the existing preference for variable rate loans (with only 2.6% of borrowers opting for fixed home loans, see graph above) — there’s potential for this trend to shift. So, with the recent adjustments in fixed rates, it’s worth considering whether a fixed loan could better suit your financial situation as conditions evolve.

Will we see more borrowers transitioning to fixed rates in the near future? Only time will tell.

Some appealing deals for fixed rate loans hitting the market

As customers start to seek better rates with the anticipated decrease in the cash rate, lenders are adjusting their fixed rates to attract new borrowers and retain existing ones. This strategy helps lenders offer appealing products that encourage customers to lock in favorable rates for their mortgages, providing them with stability regarding market rates over a specified period.

While this approach primarily benefits lenders by reducing the likelihood of customers switching to competitors, it also presents an opportunity for borrowers. For many, this could be the ideal time to secure a better deal and find a loan that better aligns with their current financial needs and goals. With careful consideration, borrowers can take advantage of these adjustments to enhance their mortgage situation.

When Is a Good Time to Move into a Fixed Rate?

Our experienced mortgage broker team is here to help you determine if refinancing to take advantage of lower fixed rate deals is the right move for you. Call our local finance brokers on the Central Coast at 1300 141 453 for personalised advice and support!